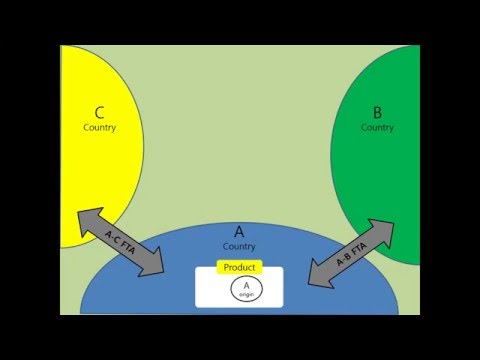

Hello everyone, thanks for watching my video. I am Kim Guano Josep. This is the 13th video of "Rules of Origin of FTA". In this video, I will talk about the accumulation rule. Before starting the video, we need to review what we learned in my 6th video, "General Rules". By applying an accumulation of new materials from FTA partner countries, our current materials are considered as originating materials, even though they are foreign materials. Let's take a look at when this rule is available in the Korea-US FTA. For example, in case a Korean producer uses materials from the USA and exports the final product to the USA, he can regard the USA materials as Korean materials. In case a US producer uses materials from Korea and exports the final product to Korea, he can regard the Korean materials as USA materials. Consequently, this rule promotes trade between the FTA countries. If a country has an FTA relationship with both a big country and a sea country, the name of each FTA is a big FTA with the big country and an AC FTA with the sea country. One day, our material was produced in the big country and it satisfied the origin criterion of the ABFTA. So, the material's origin is the P country. It moved to any country and was incorporated into a final product in the A country. The origin of the material is the B country, not the A country. So, it is non-originating material. We can change the origin of the material by applying an accumulation rule of the PFD. As a result, the origin is changing to the A country. It is an originating material. The final product is exported to the country and the material's origin is the A country. However, we...

Award-winning PDF software

Nafta certificate of origin preference criterion Form: What You Should Know

S. Of the U.S. A good is considered to be produced and assembled in the U.S. if all components or raw materials in the good originate from the U.S.-Mexico border A good is considered to be assembled in the U.S. if at least one of the items' assembly required in making the good originates within the U.S. Preference criteria, Producer, and Net Cost A good is considered to be originating and made principally of components and materials if any part of the good originates from Mexico or Canada in a way consistent with the U.S. NAFTA Preference Criteria, Producer, and Net Cost The producer of the good is eligible for the preference if it is at least 70% controlled by U.S.-based (a) entities or (b) companies in the U.S. The producer of the good must supply: Preference Criteria, Producer, and Net Cost, by Country The Net Cost is the domestic cost of goods in country of origin when they are imported into the U.S. or, if not imported into the U.S., when they are exported or delivered to the U.S. This cost is adjusted in accordance with the following table. NAFTA Preference Criteria, Producer, and Net Cost, by Country A. NAFTA producer preference is not included in the NAFTA tariff schedules (as is shown in Table 1), however, it is included as part of the country-of-origin information reported for U.S. Customs Table 1: Net Cost of a Product Entered into the U.S. by a Border Carrier Table 2: NAFTA Preference Criteria Note: The producer information should be entered on the customs data sheet provided to the importer for the product of interest. B. If you are a non-U.S. importer of goods and your product does not qualify for NAFTA preference, you cannot be certified of NAFTA import origin. For more specific information, visit the website of the United States Customs and Border Protection (CBP). The website is located at .

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Cbp 434a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Cbp 434a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Cbp 434a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Cbp 434a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Nafta certificate of origin preference criterion